Construction input prices declined 1.2% in October on a monthly basis, according to an Associated Builders and Contractors analysis of U.S. Bureau of Labor Statistics’ Producer Price Index data released today. Nonresidential construction input prices fell 1.1% for the month.

Construction input prices are 1.1% lower than a year ago, while nonresidential construction input prices are 0.7% lower. Prices fell in 2 of the 3 energy subcategories last month. Crude petroleum input prices were down 2.9%, while unprocessed energy materials were down 0.3%. Natural gas prices rose 10.9% in October. Iron and steel prices fell 2.3%.

“The October construction materials prices report should be cheered by most contractors,” said ABC Chief Economist Anirban Basu. “Yesterday’s Consumer Price Index data and today’s Producer Price Index data indicate that inflation is declining. Not only does that translate into less rapid increases in the price of many key construction inputs, but it also signifies that the Federal Reserve is poised to begin reducing interest rates at some point next year. That will support an improving project financing environment, increasing demand for construction services in the process.

“That does not mean that all risks have disappeared,” said Basu. “Among the reasons for inflation’s retreat is a slowing economy. While financial markets have been laser-focused on good news on the inflation front in recent days, less attention has been invested in the downside risks to the economy, including growing consumer indebtedness, tighter credit conditions, geopolitics and the impact of the federal government’s insatiable appetite to take on more debt.”

Related Stories

Construction Costs | Feb 27, 2024

Experts see construction material prices stabilizing in 2024

Gordian’s Q1 2024 Quarterly Construction Cost Insights Report brings good news: Although there are some materials whose prices have continued to show volatility, costs at a macro level are returning to a level of stability, suggesting predictable historical price escalation factors.

Construction Costs | Feb 22, 2024

K-12 school construction costs for 2024

Data from Gordian breaks down the average cost per square foot for four different types of K-12 school buildings (elementary schools, junior high schools, high schools, and vocational schools) across 10 U.S. cities.

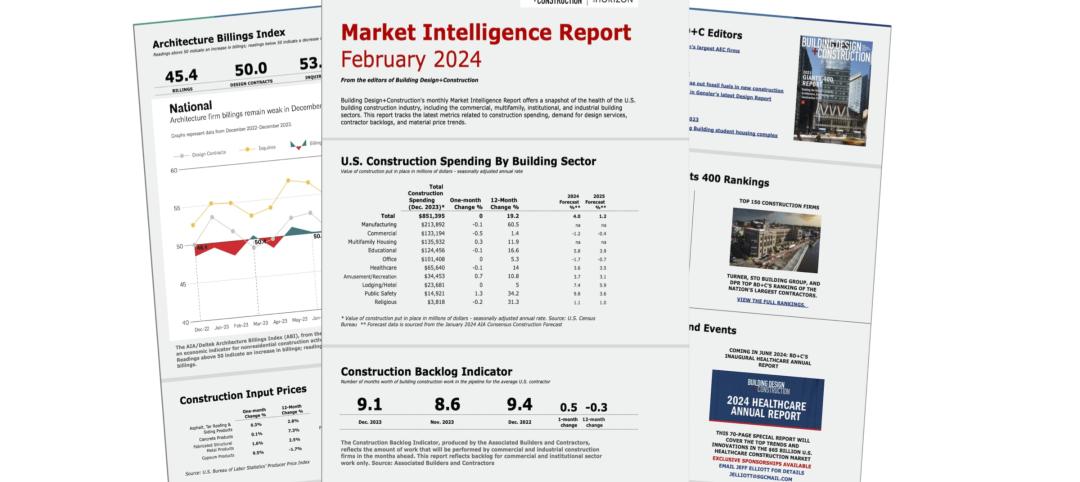

Market Data | Feb 7, 2024

New download: BD+C's February 2024 Market Intelligence Report

Building Design+Construction's monthly Market Intelligence Report offers a snapshot of the health of the U.S. building construction industry, including the commercial, multifamily, institutional, and industrial building sectors. This report tracks the latest metrics related to construction spending, demand for design services, contractor backlogs, and material price trends.

Construction Costs | Jan 22, 2024

Construction material prices continue to normalize despite ongoing challenges

Gordian’s most recent Quarterly Construction Cost Insights Report for Q4 2023 describes an industry still attempting to recover from the impact of COVID. This was complicated by inflation, weather, and geopolitical factors that resulted in widespread pricing adjustments throughout the construction materials industries.

Contractors | Nov 1, 2023

Nonresidential construction spending increases for the 16th straight month, in September 2023

National nonresidential construction spending increased 0.3% in September, according to an Associated Builders and Contractors analysis of data published today by the U.S. Census Bureau. On a seasonally adjusted annualized basis, nonresidential spending totaled $1.1 trillion.

Construction Costs | Sep 28, 2023

U.S. construction market moves toward building material price stabilization

The newly released Quarterly Construction Cost Insights Report for Q3 2023 from Gordian reveals material costs remain high compared to prior years, but there is a move towards price stabilization for building and construction materials after years of significant fluctuations. In this report, top industry experts from Gordian, as well as from Gilbane, McCarthy Building Companies, and DPR Construction weigh in on the overall trends seen for construction material costs, and offer innovative solutions to navigate this terrain.

Building Owners | Aug 23, 2023

Charles Pankow Foundation releases free project delivery selection tool for building owners, developers, and project teams

Building owners and project teams can use the new Building Owner Assessment Tool (BOAT) to better understand how an owner's decision-making profile impacts outcomes for different project delivery methods.

Hotel Facilities | Jul 26, 2023

Hospitality building construction costs for 2023

Data from Gordian breaks down the average cost per square foot for 15-story hotels, restaurants, fast food restaurants, and movie theaters across 10 U.S. cities: Boston, Chicago, Las Vegas, Los Angeles, Miami, New Orleans, New York, Phoenix, Seattle, and Washington, D.C.

Healthcare Facilities | Apr 13, 2023

Healthcare construction costs for 2023

Data from Gordian breaks down the average cost per square foot for a three-story hospital across 10 U.S. cities.

Higher Education | Apr 13, 2023

Higher education construction costs for 2023

Fresh data from Gordian breaks down the average cost per square foot for a two-story college classroom building across 10 U.S. cities.

.png?itok=sQtRMx9r)