Life has a funny way of throwing curveballs at us, doesn’t it? Just when we think we’ve got it all figured out, something comes along to challenge assumptions and leave us scratching our heads. It’s like watching a movie and expecting a predictable ending, only to be surprised by a plot twist that turns everything on its head. In the world of insurance, there’s one plot twist that never fails to surprise: the curious case of the increasing experience modification (mod) when losses go “down.”

Let’s examine this with an example.

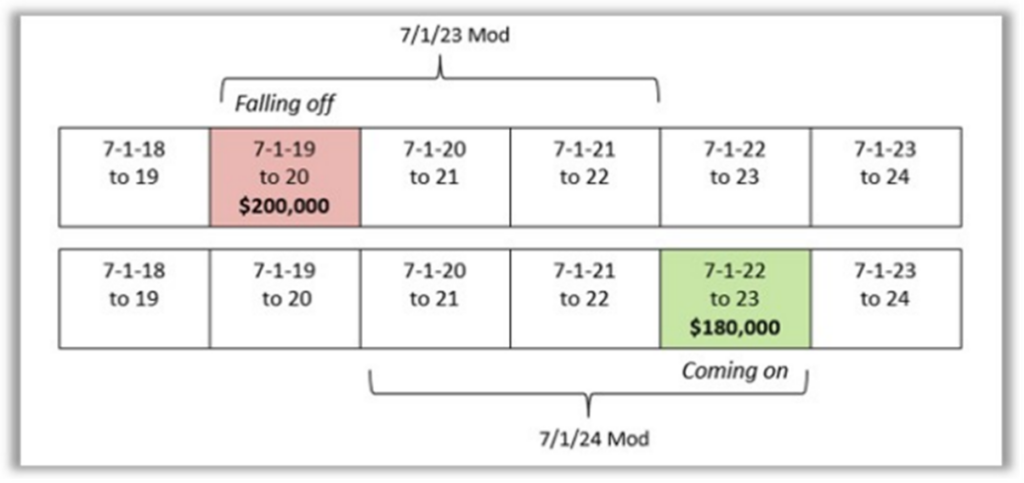

Imagine this: you diligently work to reduce your losses, eagerly anticipating a decrease in your mod for the 7/1 renewal. With each effort to trim claim expenses and enhance safety measures, you’re confident you’re on the right track. But as the moment of truth arrives, you’re met with confusion. Despite a decrease in losses from $200,000 in the year falling off to $180,000 in the year coming on to the 3-year rolling experience period, the mod doesn’t decrease – it increases, which is expressed in the graphic below.

The Path to a Lower Experience Modification Isn’t Always Straightforward

How can this happen? How can fewer losses and better risk management lead to a higher experience mod? Let’s unravel the factors behind this mystery.

Payroll Proportions

While losses may decrease, a significant drop in payroll can offset this decline, leading to a higher experience mod. The mod calculation considers the ratio of losses to payroll, so even a slight decrease in losses alongside a substantial drop in payroll can trend the experience mod upwards.

In the example, your losses reduced by 10%, but if you had 30% fewer employees, the mod may tick upwards.

Claim Developments

Claims don’t always follow a linear path. Losses from previous years may evolve over time, with new developments leading to increased claim values.

From the example, perhaps losses for the 7/1/20 to 7/1/21 period increased (e.g., a previous non-surgical claim ended up requiring surgery). This increase in losses during the “middle years” of the experience period would certainly impact this year’s mod calculation.

Industry Trends and Expected Losses

Insurance rates are influenced by broader industry trends and expected losses. Even if your losses decrease, if industry-wide expectations shift or evolve, it can affect the mod calculation. This can potentially lead to an increased experience mod despite reduced losses.

Frequency and Severity Mix

The experience mod calculation accounts for both the frequency and severity of losses, as well as the split point applied to each claim. A different mix of losses can affect the mod calculation in ways that may not align with expectations. For example, 10 losses of $18,000 each will lead to a higher mod than two losses of $90,000 each – even though both result in the same $180,000 in total losses.

Medical vs Indemnity Mix

The medical-only vs. indemnity mix is especially important in states where the Experience Rating Adjustment (ERA) is in place. The ERA reduces medical-only claims by 70%, which often impacts the mod calculation.

Experience Mods Can Be Complicated. We Can Help.

Understanding these nuances is key to accurately depicting experience mods. While the mod may appear straightforward on the surface, its calculation is influenced by several factors, each playing a role in determining the outcome. By recognizing the relationship between losses, payroll, claim developments, industry trends, and loss characteristics, you can gain a clearer understanding of why a mod may increase despite seemingly favorable decreases in losses.

Experience mods can make insurance feel even more complicated. Our experts are here to answer questions and find ways to reduce costs while ensuring your needs are met. Register for our April 17 Workers’ Compensation webinar or reach out to learn more!