The insurance industry has been experiencing a “hard market” for property & casualty for quite some time. Simply put, insurance companies are paying out more in claims and expenses than they are earning from their insured’s premiums and investment income. This causes rates and premiums to increase for insurance companies to maintain profitability.

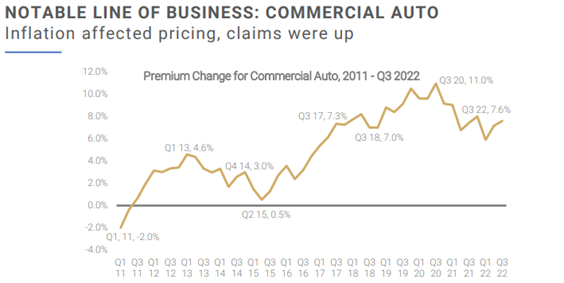

The effects of this are being felt almost across the board in the insurance that you buy — Property, Cyber, Umbrella, etc. The commercial auto market, though, has been leading the charge since around 2011. In fact, the end of 2022 marked the 45th consecutive quarter of increased premiums.

Take a look at this chart below from The Council Commercial Property/Casualty Market Index 3rd quarter report.

How Is It Possible that Rates Are Still Increasing?

Shouldn’t the market and profitability be corrected by now? You would think so, but that’s not the case.

Insurers were upside down on auto insurance for a while, so in conjunction with trying to correct the market and get back to profitable, vehicles and auto claims continue to become more and more expensive.

Here are a few reasons why:

- Inflation

- Supply chain restraints on the automotive industry

- Nuclear verdicts (massive claim payouts for punitive damages arising from vehicle accidents)

- More expensive and increased technology in vehicles; fender benders are much more expensive

- Increased number of drivers on the road, and distracted driving

Insurance Industry Reaction

Along with increasing rates, the insurance industry and underwriters are looking to policy holders to tighten up risk management practices and take more control over their exposure to auto claims. Those companies that have a more relaxed approach to fleet safety and management will have less options in the marketplace. Less options means less competition for your business, which can make it more of a challenge to hold pricing increases in check. So, what can you do?

Revamp your internal fleet/auto practices

This means conducting annual MVR checks for company drivers, placing and enforcing policies for distracted and other safe driving habits, and cracking down on employees’ personal use of company vehicles.

Consider Investing in telematics and other fleet management technology

GPS technology and cameras in vehicles are becoming much more commonplace. They not only serve as a great accountability tool, but they also give companies a foundation and data for driver training.

The Benefits of Making Safety Changes

Occasionally when discussing these options with businesses, there is concern about employees’ reaction of feeling too controlled or losing certain perks of working for the company.

My experience is that these concerns are typically short-lived, and businesses don’t look back. Implementing fleet best practices are not directly correlated with a decreased rate, but they will make your business a much more attractive target for insurance companies. The true ROI, especially for telematics and cameras, lies in the ability to defend yourself in the event of a claim.

In the event of an auto accident, it is no secret that liability often follows large vehicles and deep pockets. Commercial auto fleets check both of those boxes.

In the last six months, I have had multiple clients involved in multi-million-dollar auto accidents. Those with outward-facing cameras and driver data were able to successfully defend their position and drastically reduce their liability and total claim payouts.

I realize I just shared a lot of information with you. Do you have questions? Do you want to implement changes but you’re not sure where to start? Just reach out! Holmes Murphy consistently works with our clients to educate and help them implement best-in-class fleet safety programs.